Better Business Decisions says there are 3 Ways to Reclaim Your Power in Your Business Numbers

- Veronica Lind

- Sep 7, 2022

- 6 min read

Updated: Sep 8, 2022

✦ The business world is full of bad advice.

We’re taught to delegate, optimise, outsource and expand at breakneck speed to hit that next financial milestone. But in doing so, we leave piles of incomplete knowledge, loose ends and unchecked data in our wake.

Inevitably, the mess we’re leaving behind us eventually catches up - usually as a painful reality reflected in our finances. It’s at this time my business advisory clients find their way to me with:

A business that is a chaotic mess they can barely comprehend,

Financial data that’s completely disconnected from reality and

An army of subordinates, sub contractors and advisors, who the owner thought were there to clean up after them as they rushed ahead into the future.

If your business feels like it’s run wild and you’re not sure where to begin damage control, let me take you back to where I believe the problem begins.

It’s about the time we start delegating, hiring and outsourcing before we fully appreciate the tasks we’re handing off.

And THAT is what makes it bad advice.

We’re told too soon to make critical tasks other people’s problem in our effort to stay floating blissfully in our zone of genius.

Now brace yourself for some tough advice from Liz: you don’t get to delegate (the action) important parts of your business until you understand them well enough to check the work of your delegate (the person). Otherwise, you place yourself at the mercy of their knowledge, rather than operating from the power of your own. And nowhere in your business is this more true than in your numbers.

Now that we’ve found the heart of the problem, let’s begin on the road to recovery - here are the 3 key parts of your business finances you need to understand in order to take back your power and regain control. Only then can you delegate from a place of clarity, and effectively manage those you have made responsible for these tasks.

1. Your Chart of Accounts

This isn’t some vague part of your accounting software that is more for your accountant’s benefit than yours. This is in fact ground zero for understanding your numbers whilst also getting a clear picture of your business’ reality.

Your chart of accounts is essentially the list of categories into which all aspects of your figures can be organised. It’s everything you spend money on, all your revenue streams, everything in your business that holds value. It is how you measure your business in a clear snapshot, and can be as detailed or as broad as you see fit.

Where the disconnect usually occurs is when we subscribe to accounting software - Xero, MYOB, Quickbooks - which comes with ‘out of the box’ account names designed to be a list of generic examples. We then try to allocate income and expenses to these generic categories, rather than renaming them as it relates to our unique business. This reverse engineering of categories is where our reporting starts to get vague; the data is fast becoming disconnected from reality.

Think of it like this: in Xero, there is a standard account called 400 - Advertising, described as “Expenses incurred for advertising while trying to increase sales.” So any advertising expense would be allocated here - Google Ads Payments, Facebook Ads, radio, print, partnerships, etc.

But can you know at a glance which type of advertising is costing the most? How do you know which is the most effective? How can you compare these expenses against your marketing reports to justify how much you spend, and on what platform?

You can only manage what you measure. Try instead creating accounts in Xero for each type of advertising you invest in. Then, when you analyse the platforms sending traffic to your website, suddenly you have clear data that shows you which platform is earning its keep in your business.

Now imagine applying tailored categories to all areas of your income and expenses. A world of critical data could be at your fingertips.

2. Account Keeping Software

Zooming out from the point above, we need to get real on our accounting software.

If you were originally under the impression that it was meant to make your finances quick, simple and easy - and it’s now feeling endless, confusing and frustrating - you’re not alone.

And the way these programs are marketed to business owners is largely to blame.

Business owners are busy people with full plates and many hats. So if you can create a program that makes the administrative part of financial management seem easy, it will get snapped up by time-poor entrepreneurs.

The trouble is, the administration of our numbers is not the most important part.

It’s about understanding the figures, reading them as if they’re telling you the story of your business at any given moment, and being able to use them to make better decisions. It’s the knowledge that comes with manually handling the finances that is what many business owners are now sorely lacking.

There are no shortcuts to fixing this one. It’s more about making a commitment to yourself and your business. Committing to being more engaged in your finances, moving past any feelings of ‘not being a numbers expert’ and stepping into your power as being an expert on your business, inside and out.

3. Kicking It Old School with End-Of-Month

Whilst larger companies may still do this, end-of-month processes have largely fallen out of practice. What was once a necessary process as part of manual accounting actually had the double benefit of being a healthy, monthly ritual for business owners.

It’s time to bring a bit of monthly ‘me-time’ into your business habits. This will be a hugely positive step in working towards the level of knowledge I outlined in point 2.

Set an appointment in your calendar for a monthly power hour (or two) and identify the key areas in your finances worth keeping an eye on regularly. A great idea would be to involve your bookkeeper in this process; having two sets of eyes on the numbers can only be a good thing, and setting the time set aside with someone else present will only keep you more committed to the appointment.

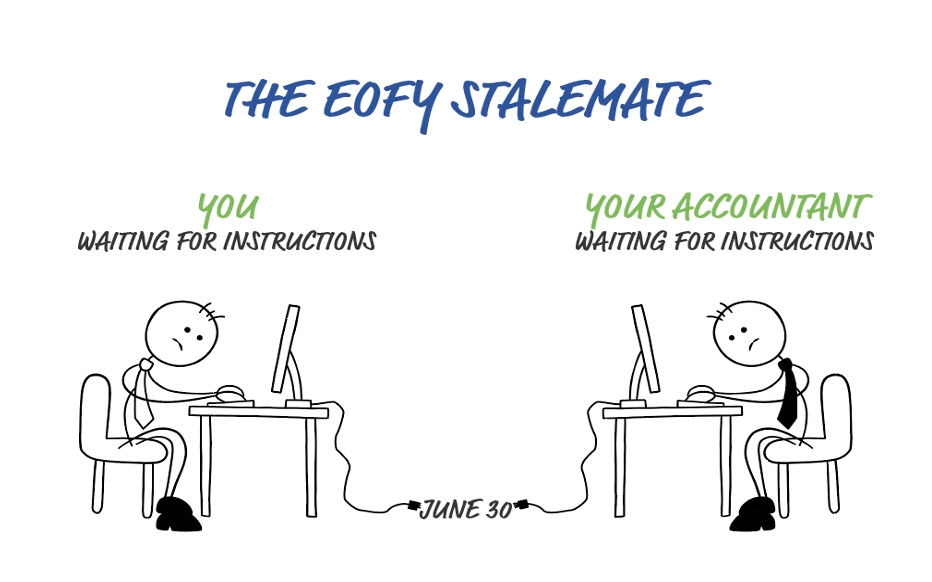

Whose job is it really?

This is the broader question we need to be asking ourselves before we start a delegation frenzy.

Is it really your bookkeeper’s job to ensure all the categories of data are set, so you can measure exactly what you want to manage? How will they know?

Is it really your accountant’s job to tell you if something is going wrong? Again, how will they know?

Don’t fall into the trap of ‘leaving it to the experts so you can stay in your genius zone.’ (Translation: ‘leave the hard, confusing things to other people so you can stay blissfully ignorant until reality comes for you, stick in hand.’)

You may not be a financial genius. But you are the highest authority on your business. Don’t outsource tasks until you have a strong understanding of the fundamental principles of what you are delegating. Because no matter how reliable a team you build, you are still the one that retains the 10,000ft view to see how it all comes together.

If you’d like support in getting clarity, establishing regular financial habits or even just getting your head around your chart of accounts, I’m the business mentor for you - book a FREE 30 minute chat with me and let’s get you your power back: https://betterbusinessdecisions.com.au/

Book a Chat

Liz Jarvis BEc CA

Better Business Decisions

Phone: D 02 6553 0274 M 0409 570 522 Email: liz@betterbusinessdecisions.com.au

Youtube Channel: https://www.youtube.com/channel/UCd_7znD53DbzVfmLoFPVZWQ

Disclaimer: These are yuck and boring but unfortunately a legal requirement for professionals in my industry. So just a reminder, the information contained here is general in nature and you should seek financial and business advice tailored to your own personal circumstances. Which, by no small coincidence, I can help you out with. Head over to my website and book a free 30 minute chat with me: https://betterbusinessdecisions.com.au/

Advertise with Brilliant-Online

✦ Brilliant-Online is the only publication that offers a single interactive multichannel advertising package.

✦ The purpose of Brilliant-Online is to push for a better world in the digital era.

✦ Brilliant-Online is an empowering read for progressive individuals and dynamic businesses.

✦ For all enquiries about advertising with Brilliant-Online, please contact us here.